And it doesn’t require demonetisation of curreny notes.

Nor do Indian citizens have to perform yagna, prove their patiotism by standing in queues for that. Neither is it a fix – quick, slow or one-time. And it works, in long term, as well as short and medium. No pain for economy, no adverse impact on GDP. Most important, it poses no threat to PM’s life; and he won’t have to relinquish his seat for failing.

Involves just four actions, each one very saral. First, uses simple economic principle; second and third require a slight modification in existing tax laws. And fourth works only if you and I change, just a wee bit (small pain for us, big gain for desh).

Economics of changing colour

Economics is about balancing resources – moving resources from where they are abundant to pockets they are scarce. And vice versa. Uber and Ola’s surge pricing is an example we all can relate to. So is Indian Railways tatkal booking and airline pricing their first 5% tickets at fraction of the last five. And the vegetable vendor whose prices for fresh vegetables in the morning are generally two to three times higher than in the evening when he has to clear his stock of perishables. Sellers adjust their prices to balance demand and supply, ensuring everyone goes home happy. When many sellers and buyers collectively take decision, its termed market, like the Sensex. While the market adjusts dynamically over period, intervention through incentives and disincentives can be used to nudge buyers and sellers towards desired behavior.

Estimates suggest that India moves on cash – 98% of transactions being conducted in cash (see chart). No just small value daily purchases of groceries, but big value purchases like gold, cars, bikes, expensive phones and foreign trips. And cash seems to be oxygen, as well as water, for business and wages in much of India.

Statistics indicate barely 30 million (3 crore people, 2.5% of population) in India use non-cash modes to pay for most of their purchase. For example, though I use credit card as often as 25 times month, I use cash just as frequently, if not more. And my behaviour is NOT representative of a typical non-cash user, as, according to RBI, an average credit card is used no more than 3 times a month!

A proportion of cash transactions turn into ‘black money’ when a seller doesn’t show it in his books of accounts, and consequently under-declares his taxable income. However, if more and more people (both sellers and buyers) shift to electronic mode for transacting, cash usage will gradually reduce, and a lot of money will become visible, or ‘white’. This is excellent for economy in several ways: people who spend will become visible; the money they spend will get accounted and fetch the government correct amount of tax, both direct and indirect. And the good news is that this is already happening.

Non-cash mode of payments account for approx 5.5L crores, up nearly 30% from previous year – that’s 3 times the growth rate of organised retail and 5 times the growth of GDP. Left untouched, this is bound to reduce cash usage to half of what it is over the next 10-12 years. But this can be hastened 1.5 to 2x by applying laws of economic principles – offer incentive to sellers to accept cash and make the buyers pay extra when they pay in cash. In less than 5-7 years, India can see non-cash overtake cash from present 90%. [Government announced some measures in this direction as I write, but these are unlikely to have any significant impact]

To bring this change, both from buyers and sellers’ perspective, two things must happen, and happen simultaneously.

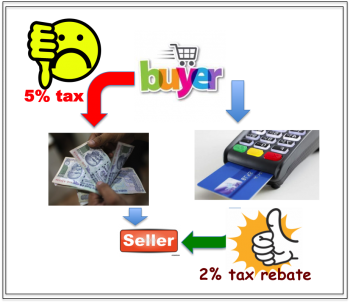

Disincentives for spenders on their cash transactions – say 5% higher price for all cash transactions. And incentives to sellers for preferring non-cash mode of payment. Say, a 2% tax waiver.

Here’s how this can work:

Every time you shop (or spend), you’ll have to shell out 5% extra when you pay by cash. Outcome: Seller will start telling customers, “Card se do, pay 5% less”. Those who still prefer cash, pay more. And the government will collect 30-40% extra tax. Assuming 80% of taxable sales and services transactions are conducted in cash, Government could end up netting between Rs.40,000 to 45,000 crore extra tax annually. Believe me, 5% in enough disincentive, and will pinch, much like paying Rs.3 for a plastic shopping bag hurts every time I shop. It will work far faster and better than doubling the number of income tax officers, quadrupling policing and other enforcement expenses, and bank (literally) on demonetisation.

The second part of the plan is to offer a 2% tax rebate on all non-cash transactions to sellers. This is even more important the 5% extra charged for cash transactions from buyers. Because, non-cash transactions eat into sellers profit, reducing it by up to 20% annually. Why? Because card payment entails between 1 to 2.5% extra expenditure for the seller. In today’s highly competitive world, giving up 2% of sales value can drive a profitable business into red. On the other hand, if sellers are offered a 2% waiver in tax, the cost of card transaction to them would become zero, shoring up their profitability.

What about loss of tax revenue to government? Government suffers no loss. In fact it gains, as it receives 5% on cash transactions and loses 2% on non-cash. Assuming cash and non-cash transactions were equal in value, Government would still end up netting 3%.

This simple taxation will discourage buyers from using cash and make sellers prefer cards and other electronic modes. Bear in mind, at this point in time, only 1 in 25 sellers accept card payment. And many of them ask the buyer to pay 2% extra if they choose to pay by card.

The gains for government as well as the economy could be unprecedented.

- Additional tax revenue.

- More and more spending is accounted.

- Lower requirement of printing currency notes, stocking them, transporting them, distributing them through ATMs, etc.

- Economy gains, as it progressively moves away from cash to a non-cash at a far faster pace.

At a moderate 8% adoption per annum, I believe we can reduce 98% cash transactions to about 50% in 7-8 years.

Two small tweaks in law, big attack on Black money

Tax on agriculture income. As most farmers are ‘poor’ (and the fw who are rich are either politician or have political clout), no government is willing to bell this cat. In fact, it’s not even compulsory to declare income from agriculture as part of your total income when you file your tax returns! So this money, in the hands of the rich farmers, remain unaccounted, or ‘black’. To bring it into the net, government needs to focus only on the rich farmer. It could take lessons from it direct tax provision called Minimum Alternate Tax (MAT). To explain MAT, all companies who book a profit but still end up having a net loss after availing applicable deductions and benefits (including depreciation), have to pay 18.5% of book profit as MAT. Using the same principle, all rich farmers (large and medium land holdings) can be asked to pay MAT, say @ Rs.10,000 per acre every year unless they declare their agriculture income as part of total income. 0.7% of 140 million land holdings in India are 10 acres or above, and around 5.5% are between 6 and 10 acres. If each of them pay MAT on basis of their respective land holding, government stands to collect approx. Rs. 75,000 crores annually. And those who don’t pay MAT, end up declaring their income to avail a rebate. Remember, this keeps 94% of the farmer out of tax ambit.

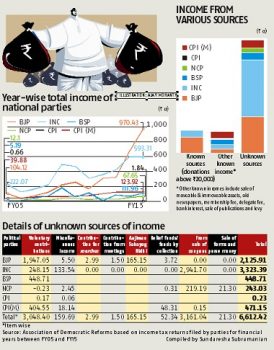

Cash donation to political parties. It’s no secret it costs Rs.8-10 crore (conservative estimate) to contest national election per constituency for each party. Assuming all parties between them spend Rs.25 crores in each constituency, this works out to a whopping Rs.15,000 crore for all the 542 Lok Sabha seats. To this amount if you add expenditure on 20,000 plus seats contested for state elections at Rs.10 crore a seat, we’ll be in Rs. 200,000 crore realm over five years, or around Rs. 42,500 crore annually. Most of this money is unaccounted and is used to pay the voters or is spent as petty cash. To fund accountable parts of their expenditure (like radio, TV, digital, travel, boarding lodging, etc.), political parties rely on large ‘accountable’ donations. According to a recently published newspaper report in Business Standard, the top three political parties (Congress, BJP and CPI) received Rs.6600 cores over last five years that’s recorded under ‘unknown sources’. While no individual or business is allowed to have income under a head like this, political parties enjoy immunity.

How? Political parties are allowed to receive cash donations they needn’t declare the sources as long as each donation is less than Rs.20,000! Isn’t this bizzare! While government preaches transparency and takes the black money battle to ground, political parties stay opaque. Obviously, to begin charity at home, Mr. Modi will do well to call an all-party meet to make it mandatory for parties to declare sources of their cash. The battle for unearthing black money will remain unfulfilled till political parties continue to stay privileged.

I believe by encouraging non-cash transactions, taxing rich farmers and making political parties practice what they preach, generation of unaccounted cash will reduce to trickle over period. And wherever, whatever little is generated, will bring additional tax for country’s development. Of course, I’m assuming the other steps goverment takes on progressively, like GST, reduction of income rates and strict and fair enforcement of compliance, halving the tax on property registrations – all will all help reduce the generation of black money further.

One small step from each us can kill black money in its tracks…

Finally, there is tiny step all of us can take to stop generation of black money. It’s called 60:40 in property transactions, where we pay or receive part of the property value in cash. 60:40 is seriously dangerous as it converts a lot of hard-earned white money into black whenever we pay for property purchase. And white into black when we receive it for our selling property.

Why do perfectly honest middle-class people participate in 60:40? One reason is greed, or an opportunity to pocket something extra without paying tax. The other is very high property registration charges – going up to 15% of property value. While government can help by reducing stamp duty on property registration, it will be far greater help if we do something about it voluntarily. I know this is not as easy as slight inconvenience we are subjecting ourselves by standing in long queues to eliminate black money, as this involves giving up ssubstantial gains, running into lakhs! Question is: can we? And who will be first?